A Deep Dive thread on Uniswap V3 Pool & DeFI Edge protocol

You cannot talk about DeFi as a whole without talking about Uniswap, which is the largest Automated Market Maker (AMM).

After the launch of Uniswap V2 in may 2020 which facilitated over a trading volume of $135B making it one of the largest DEX in DeFi.

There were so many limitations & area that needs improvement which led to the launch of V3 & that is a game changer and a new era for other AMMs.

Below are some key features about Uniswap V3

Concentrated Liquidity

Capital Efficiency

Multiple fee tiers / Flexible fees

Active liquidity

Range Orders

Concentrated Liquidity: Users can concentrate thier capital at custom price ranges in which they can provide liquidity within the desired price & that offers more capital efficiency for LPs.

Capital Efficiency: Capital Efficiency which is among the main feature of Uniswap V3 enables user to put far less capital at risk while providing liquidity & also earning more trading fees within the specified ranges.

Unlike providing liquidity in Uniswap V2, you earn same fees with V2 LP while maximizing your capital. Let's take for instance: A & B has $10,000 each & wants to provide liquidity on ETH/USDC pool on Uniswap V3 Price of ETH is 1300 USDC.

A chooses to spread it across the entire price range (5000 USDC & 3.842 ETH) as he would have in Uniswap V2.

Then B chooses to concentrate hers by depositing within the specified range of ETH from 1000 - 1700 i.e making use of 3000 USDC out of 10,000 USDC. (1500 USDC & 1.15 ETH).

Then she keeps the remaining $7000 to use it as she prefers. So in similar case A & B earns the same amount of fees as long as ETH/USDC stays within the specified price range 1000 - 1700.

So B has maximized her capital & stands more chance against A if eventually price of ETH plummets & goes to 0. A loses all his capital whilst B has $7000 remaining to hedge against this case scenario.

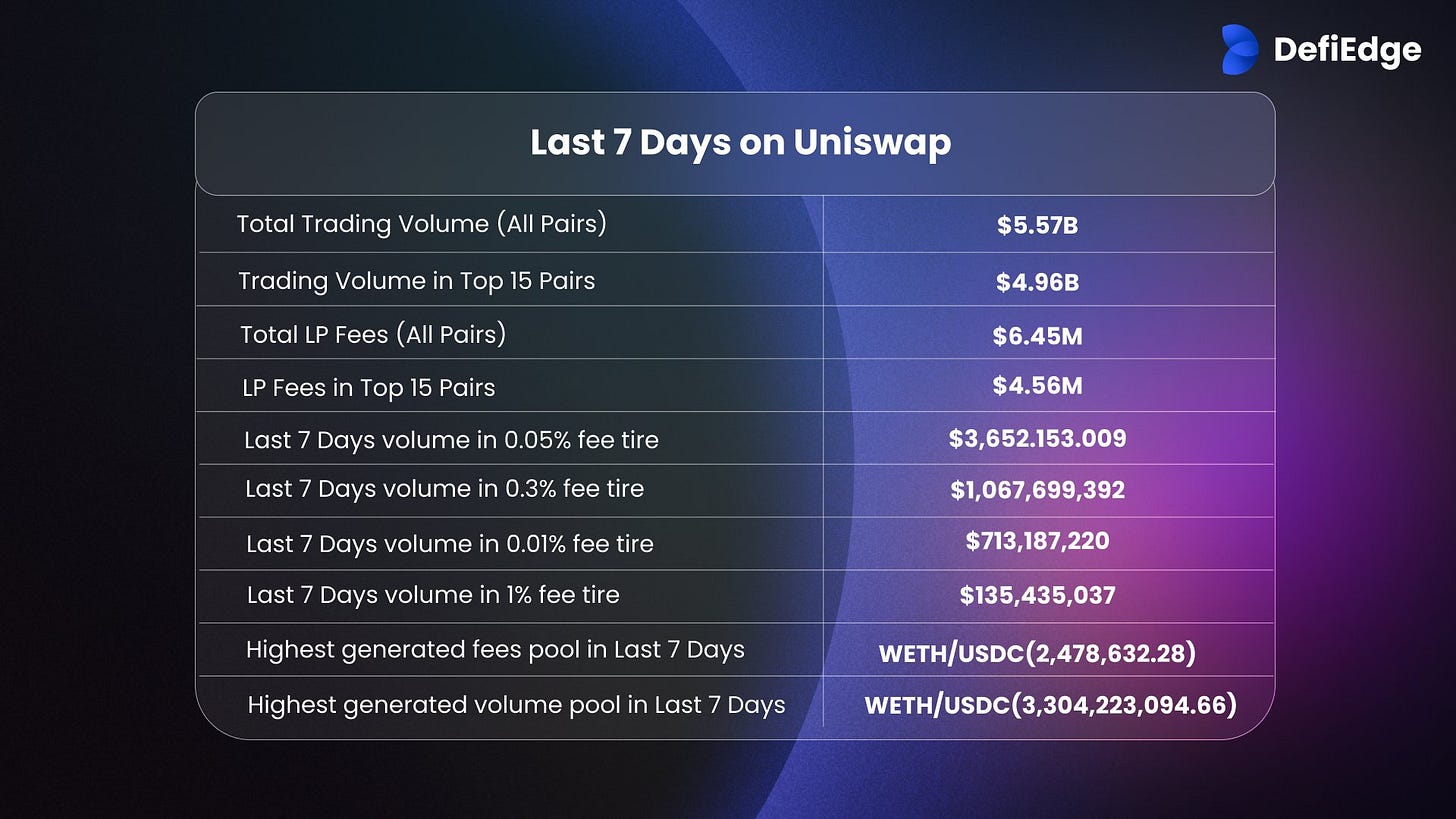

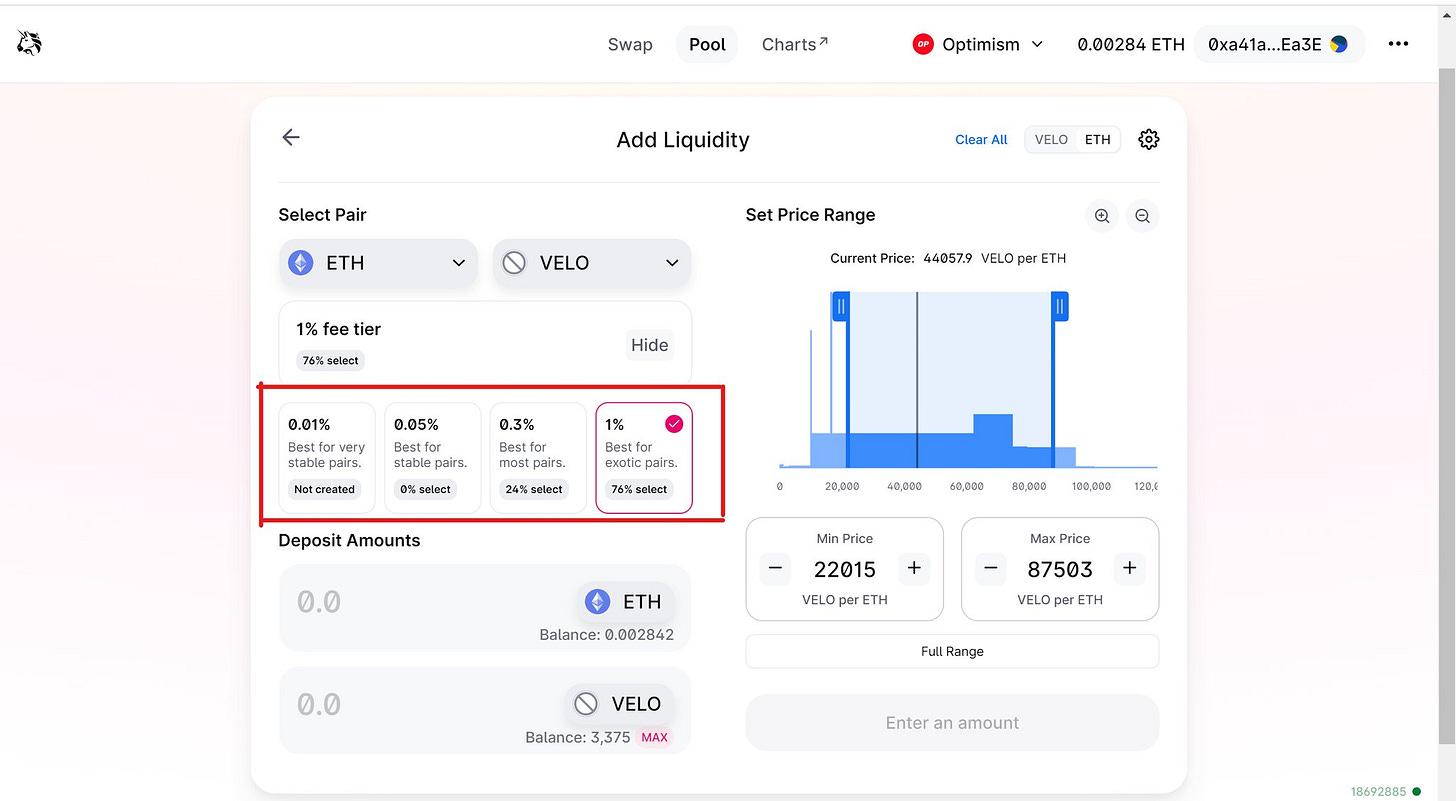

Multiple fee tiers / flexible fees: As the name implies, it allows LPs to take different varieties of degree of risk based on thier preference which are 0.05%, 0.3% and 1%.

Active liquidity: At the specified price range selected by the LP, its position continues to earn fees, but when the market prices move outside the specified range, it stops earning fees till the market prices move in the range again or they decide to update to the current MP.

Range Orders (Range Limit Orders): It allows LPs to provide a single token as liquidity above or below the current price. When the market price enters into the specified range, one asset is sold for another while swap fees are earned.

For instance, let's say A wants to provide liquidity on USDC/USDT pool within a narrow specified range 1.01-1.02, Once USDC trades above 1.02 the whole LP position is converted to USDT.

In that way A can withdraw the liquidity so it won't automatically have to convert back when USDC is trading below 1.02.

So that's all you need to know about Uniswap V3.

Now, let's deep dive into DeFI edge protocol @DefiEdge

DeFI Edge is an asset management protocol built on Uniswap V3 which simply allows LPs to add liquidity on different strategies while earning fees on the Liquidity provided.

Since the protocol is permissionless, you can create a strategy yourself or use existing strategies to provide liquidity.

Similarities b/w DeFI edge & Uniswap V3 Pools

Just like Uniswap V3, DeFI edge works similar to that with some exciting features which makes it a great choice of use over Uniswap V3.

Below are the limitations of Uniswap V3;

DeFI Edge solves this by the following ways:

Connecting LPs with Startegy managers to optimize user investment in the V3 Pools.

It solves the issue of active liquidity whereby the strategy manager constantly rebalances liquidity to the specified price range instead of the LPs doing so.

Achieving High APY from Uniswap V3 Pool involves the LP selecting the right price ranges but the strategy manager at DeFI edge protocol sees over that by allocating capital in complex price ratio to generate best returns over the investment.

Issues of high transcation cost in which the LPs in Uniswap V3 has to constantly monitor & readjust thier liquidity price position, The strategy manager saves the cost by rebalancing the users liquidity.

Getting familiar to using DeFI edge protocol

You can use DeFI edge protocol in two ways;

By adding liquidity on existing strategies

By creating a strategy (which makes you a strategy manager).

Adding Liquidity on Existing strategies

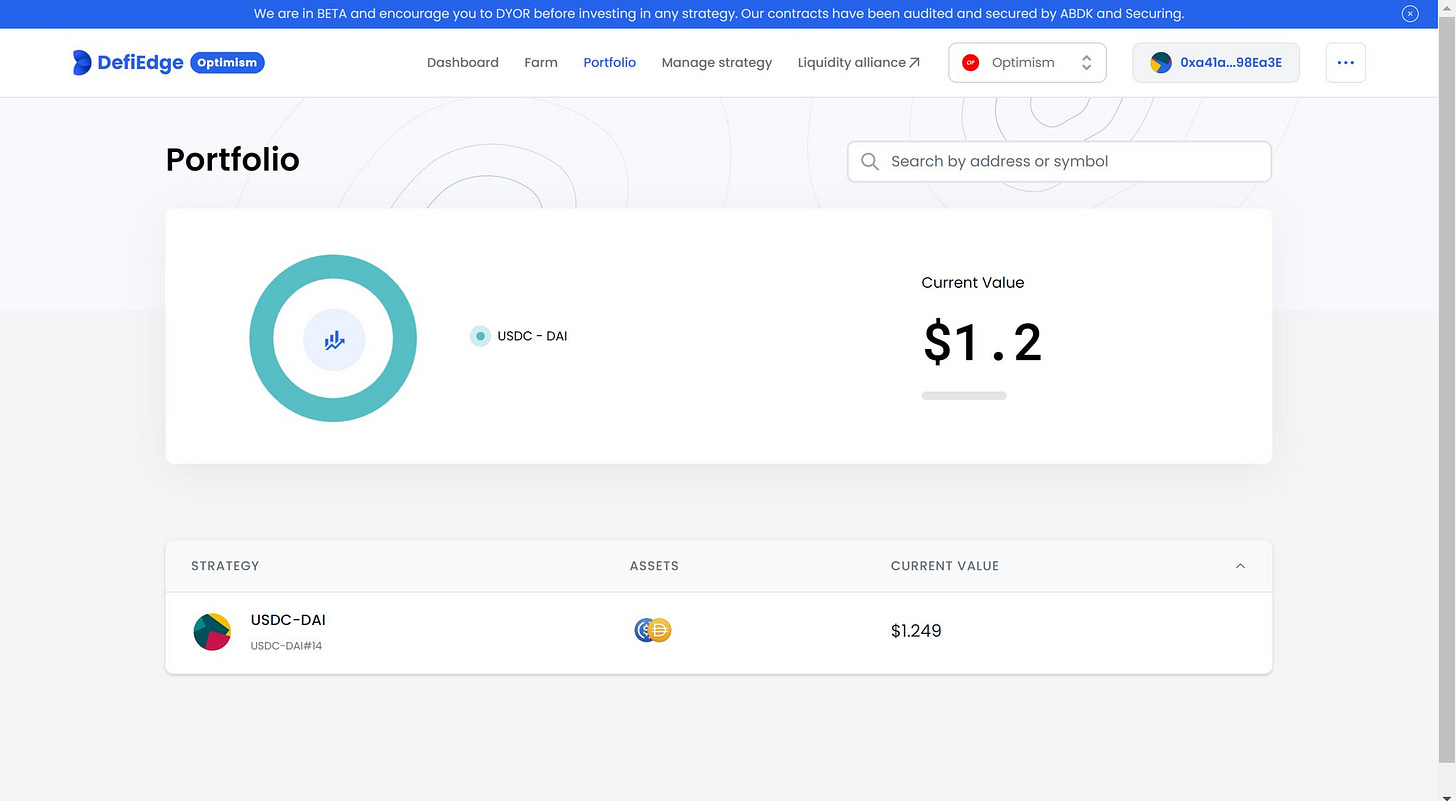

Below are the steps I took on adding liquidity on USDC - DAI Pool;

Created a position on USDC - DAI

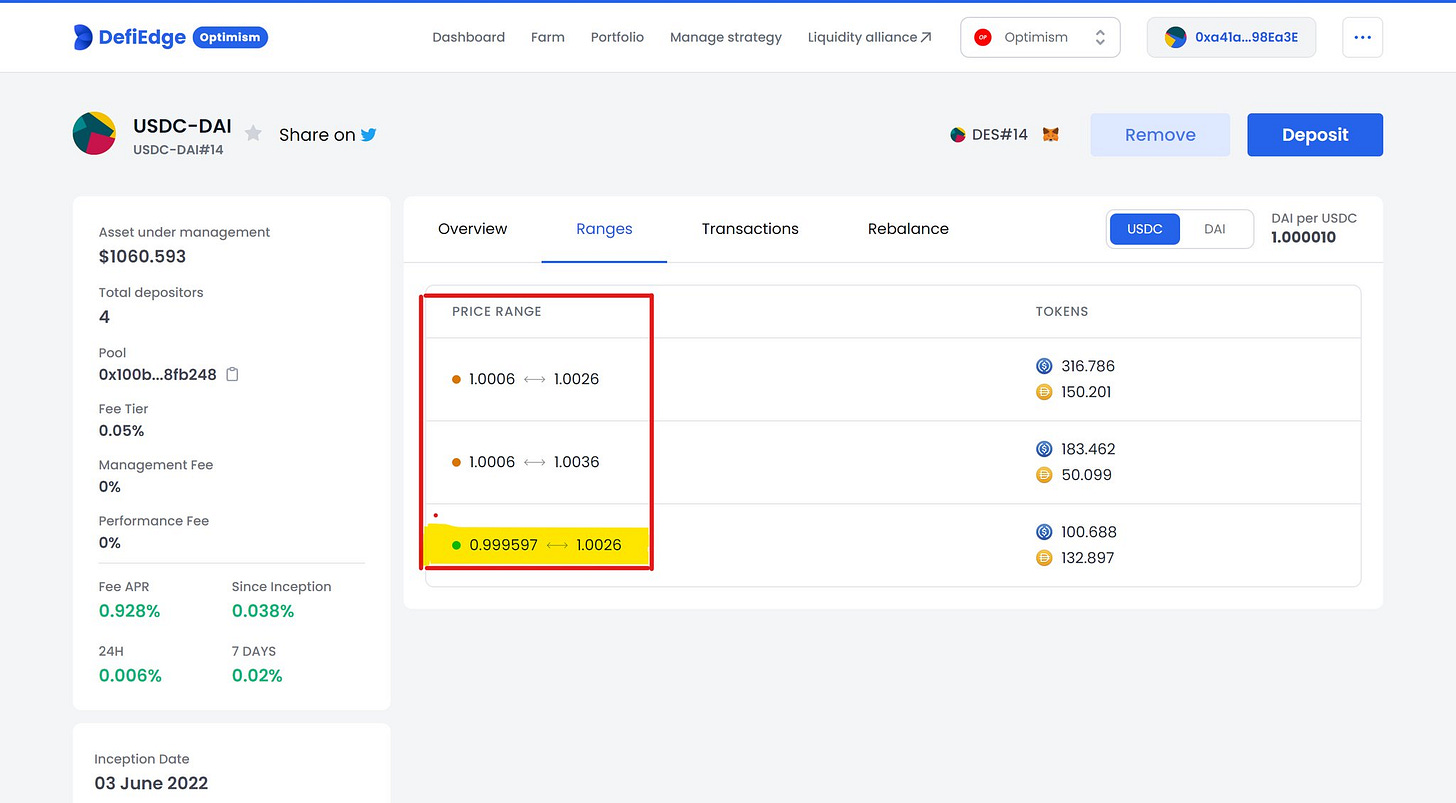

The section indicated with the red mark shows general info on the startegy I provided liquidity on, as you can see below it has a fee tier of 0.05% (as per multiple fee tiers) from the Uniswap V3 section & this varies depending on the risk, stables tend to have low risk.

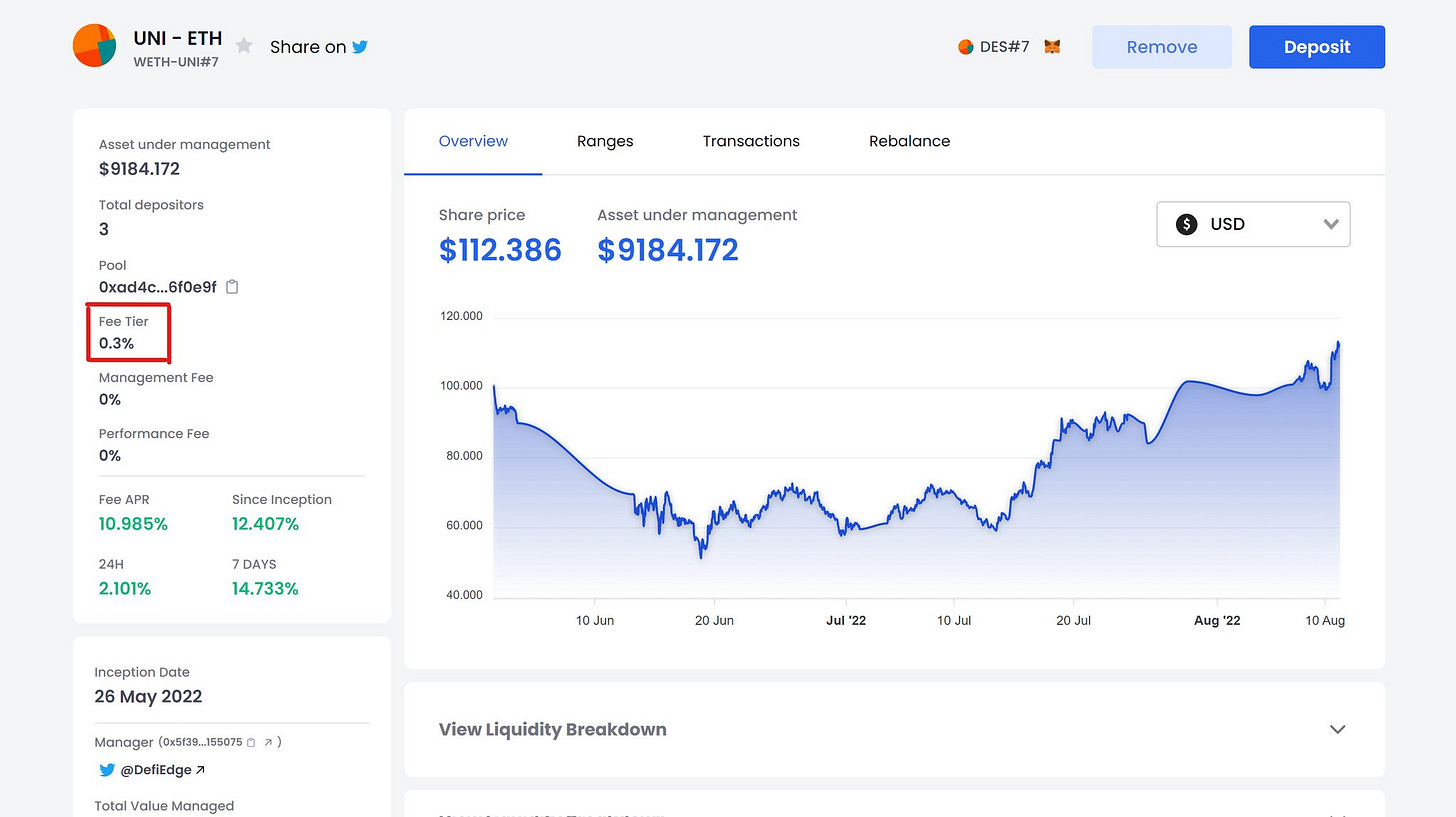

As you can also see below on UNI - ETH Pool, both pair are not stables or at least with one stable, that's why it has a 0.3% Tier fee & also a higher APR than the former.

Also the range section show the specified ranges created by the strategy manager in the USDC - DAI Pool. Also note the range can be up to 20 different positions.

The highlighted area above with the yellow marker shows the current price at which the token pair is trading & is currently earning fees that's why it's green dotted. The other range position are not earning fees because the market price is not within that range.

Finally below attached is a complete guide on how to create your own strategy. 👇

https://docs.defiedge.io/guides

Thanks for reading thedefisaint's newsletter. Subscribe for free to keep yourself updated and support my work.

Also you can follow me on medium @medium/DeFiSaint