Chainlink CCIP

Good Morning Saints,

I hope you’re having a wonderful weekend.

If you’re reading this, you’re always one of the chosen Saints and special.

Today, we’ll be exploring everything you need to know about Chainlink CCIP (Cross-Chain Interoperability Protocol).

Chainlink's Cross-Chain Interoperability protocol (CCIP) is mitigating users' dilemma on moving assets across different chains. First off, we need to reiterate the current state of blockchains and why seamless Interoperability is needed.

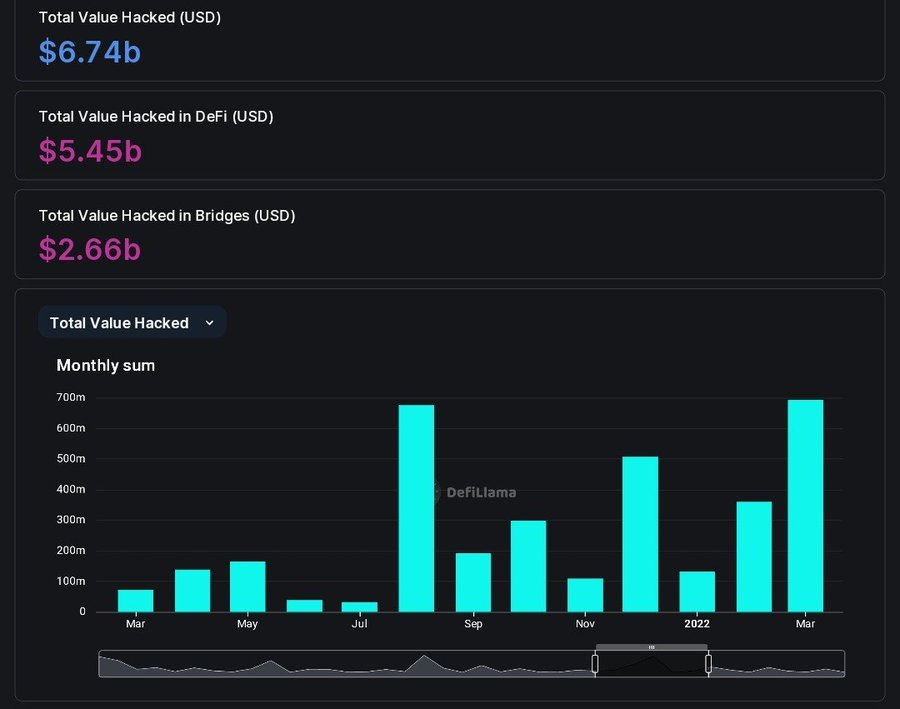

Blockchain Interoperability simply refers to the ease with which blockchains interact with one another. Why is it needed? According to DeFILlama, there are 201 chains and counting with a total TVL of $43.7B, with Ethereum having the largest share (57.52%) and a TVL of $25.03B.

Liquidity is fragmented across these several chains; Some protocols are built on different multiple blockchains (Multi-chain). Also, users across these multiple blockchains need to interact with other blockchains, which can be to move assets; it can also be protocols that wish to deploy their Dapp further to expand to different chains. This is not easier than we think. Also, the underlying mechanics behind these designs are that they follow a set of protocols.

For users to move their assets across these several chains, Cross-Chain bridges are needed, but are they the best solution? They would have, but not secured as we thought. Bridges are the honeypot for hacks; why?

It's simply because of their design in which they lock assets on the source chain and mint these assets on the destination chain, thereby introducing the wrapped version, and upon moving these assets back, they are unlocked on the source chain.

Hackers often target the pools where these assets are held due to huge amounts of funds being locked. To date, $2.66B has been hacked in Bridges.

Cross-Chain cannot just become obsolete if we keep having multiple chains and liquidity is not unified. Then what is the solution?

Robust Cross-Chain solutions

Chainlink, with its CCIP, is making this a reality.

Here's How:

Chainlink CCIP recently went live on Mainnet across various EVMs, which includes Ethereum Mainnet, Avalanche, Optimism, and Polygon.

Chainlink CCIP is building the standardized Interoperability solution for blockchains, leveraging security, flexibility, and community to accommodate all Cross-Chain use cases.

It provides the following:

Cross-Chain collateral

This will allow users to borrow to deposit collateral on one blockchain and borrow assets on another. Example: Let's say a Radiant user has $USDT on Arbitrum and not on BSC but wants to supply collateral on BSC.

If Radiant Implements CCIP, No need to bridge $USDT from Arbitrum to BSC. The user can now simply supply collateral with $USDT on Arbitrum directly without the need for bridging.

Cross-Chain tokenized assets

This will enable token transfers across different blockchains from a single Interface. No need to build your own bridge solution.

Cross-Chain NFT

Mint NFT on the source chain and receive it on the destination chain.

Cross-Chain Account Abstraction

This will enable wallets with CAs with native CCIP to make a Cross-Chain function call. Users can now approve txn on any chain using a single wallet.

Cross-Chain Gaming

Now, Gamers can store valuable assets on a more secure blockchain while playing on scalable blockchains, e.g. Store assets on Ethereum while playing on Arbitrum.

Cross-Chain LST

This will enable the expansion of LSTs across Multiple blockchains to increase their utility. e.g. how Rocket Pool's rETH is on Ethereum, Optimism, Arbitrum, and currently zkSync.

You can use rETH on these chains for lending, yields, and more.

Cross-Chain Liquidity and Cross-Chain Governance

Synthetix implements CCIP for transferring synth liquidity which allows sUSD to be burned on the source chain while minted on the destination chain.

AAVE equally Implements CCIP for its Cross-Chain Governance because of its gas-efficient design and finality time.

Chainlink is not just bridging the gap between off-chain and on-chain systems through oracles; it also boasts of being the one-stop shop for robust Cross-Chain solutions.

Here's what makes Chainlink's CCIP unique from other Cross-Chain solutions:

Simplified Token Transfers

This will enable protocols to easily transfer tokens across chains using audited token pool contracts they control without writing custom code. This will support both lock and mint & mint and burn models.

Rate limit

rate limit customization will enable the number of tokens to be transferred within a given time limit, which is set in alignment with the token issuer. This will also serve as a hedge to protect pools from being entirely drained against hacks.

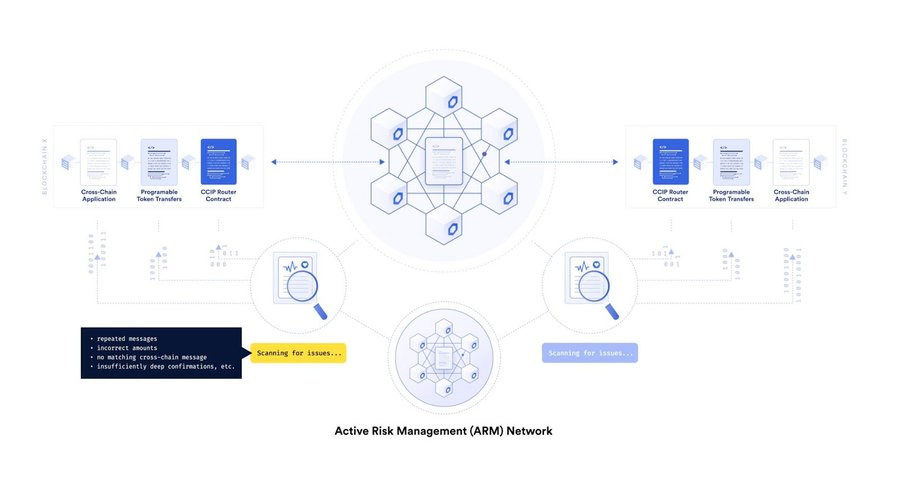

Active Risk Management Network (ARM)

This monitors the validity of all Cross-Chain Txn by providing extra layer security. This uses a separate minimal rust implementation of chainlink node software.

This also minimizes external dependencies to prevent supply chain attacks.

ARM is the heart of CCIP and also the most important validation services for gate-keeping the cross-chain process .

The ARM system is made up of:

a. Off-chain ARM nodes (Multiple)

b. On-chain ARM contract (Only one)

Off-chain ARM nodes are the secondary validation service that runs in parallel with the main CCIP system, but with a different codebase as DON. Therefore, if a security vulnerability occurs in the DON network, the ARM nodes can remain unaffected.

Blessing and Cursing Within CCIP, the off-chain ARM nodes are responsible for voting operations known as Blessing and cursing.

These operations serve as a voting system to determine the validity of a Merkle root.

The blessing works by First, each node monitors all the Merkle roots that are committed to the destination chain by the Committing DON . Then, each node retrieves all the messages from the source chain to independently reconstruct the Merkle root.

Subsequently, the nodes verify whether the roots committed by the Committing DON match the root constructed by the ARM nodes. If the roots match, the ARM nodes bless the root on the destination chain.

To be "fully blessed," the root must reach a quorum, the weight of which is tracked by the ARM contract.

However, what happens if the roots do not match?

If the results don't match, the ARM would curses the Merkle root

Similarly, to be "fully cursed," a quorum of votes must be reached. Once the root is cursed, the CCIP process pauses until the contract owner assesses the situation and lift the curse.

There are two types of violations where ARM nodes can also pause on CCIP:

a. Execution Safety Violation: When a message/txs is executed without a matching txs on the source chain.

b. Finality Violation: A deep reorganization which violates the safety parameters of CCIP.

The on-chain ARM contract is responsible for assigning "blessing" and "cursing" weights to the ARM nodes .This contract also maintains two thresholds to determine the quorum for both blessing and cursing.

If the sum of "blessing" weights exceeds the threshold, the ARM contract considers the contract "Fully Blessed", the same logic applies to "cursing". The owner has the ability to revoke a "Curse" by addressing the underlying issue and lifting the curse on behalf of the node.

Programmable Token Transfers

This gives more specific instructions on how tokens transferred will be used on the destination chain.

This can be when tokens arrive on the destination chain; they can be swapped to another token, staked, or used as collateral. This can be done in a single transfer, similar to 1 click multi txn experience.

Smart Execution

This will enable gas-locked fee payment; users can now have a fixed gas payment without worrying about gas spikes on the destination chain.

Payment Model

With its CCIP, Chainlink is currently implementing an enhanced fee model to provide means of monetization for Chainlink service users.

Chainlink is also working on automated on-chain payment where fees made in other assets are converted to $LINK. This is quite bullish for Link Marines.

Timelock Upgradability

This will enable any security-critical changes or upgrades made to CCIP to undergo a timelock smart contract where a vote is cast by a quorum NOs before any changes are made or clearly approved by the quorum without a timelock.

This is just the beginning, as there are more opportunities to explore with Chainlink's CCIP. Chainlink CCIP also provides Cross-Chain connectivity for capital markets.

Swift and several financial institutions and market infrastructure providers are currently exploring CCIP for token transfers across public and private chains.

Chainlink's CCIP is forever changing the Cross-Chain tech and introducing a dynamic shift toward mass adoption.

The future can't still be agreed to being Cross-Chain, Multi-chain, or Omnichain until we see any moving to the path of meaningful adoption. Chainlink CCIP is already moving towards that.

Thanks for reading, and if you like it, do leave feedback and forward it to your Friends. There is love in Sharing, and see you next time.

DeFI Saint

Founder, The Saints Creed.