Intent-Centric: A Narrative worth keeping an eye

Good Morning Saints,

I hope you’re having a wonderful weekend.

If you’re reading this, you’re always one of the chosen Saints and special.

“What will onboard the next wave of users to DeFI?”

This particular question has been asked countless times

The answer simply lies “a lot,” but first and foremost, we should always go back to the fundamentals because if it’s solved, anything else can onboard the next wave of users to DeFI.

From Account Abstraction to Chain Abstraction and from Chain Abstraction back to Account Abstraction, and finally down to the fundamentals.

Ladies and Gentlemen, I present to you “Intents” or rather “Intent-centric”, and in summary, it all comes down to users now being prioritized over anything else.

Paradigm sees the future and is currently exploring this; I also see the future.

DeFI keeps getting matured day by day, the current state of DeFI since inception hasn't remained the same till today. Everyday we see new narratives emerge and they come and go, some being impactful while some being a chamber for malicious actors profiting off retail.

"Intent-Centric" is what will change DeFI forever, it'll give the whole DeFI a seamless CeFi-like experience and more. The average DeFI user doesn't know their way around many Protocols or some strategies to play around like some DeFI experts.

DeFI is made for everyone and for mass adoption to come to DeFI, it needs to provide a more seamless experience than CeFI. This can be Account Abstraction, Chain Abstraction and many more. In summary, "Intent-Centric" has been the missing block.

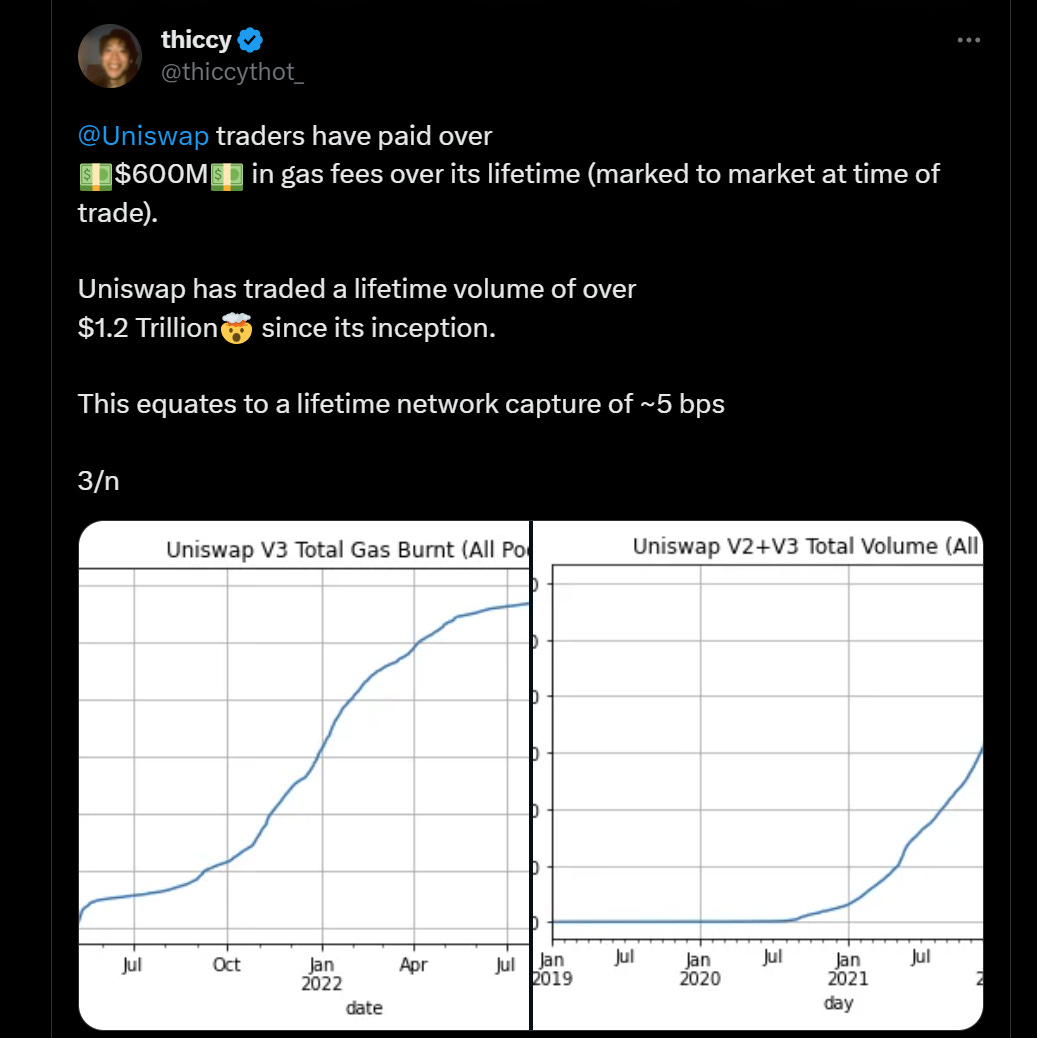

DeFI UX sucks, no matter how we strive to claim it doesn’t. This is why most average users/normie prefer the use of CEXes to trade, stake and many more. CEXes are chainless, you don't even need to approve multiple transactions before any action is completed.

This alone can save users countless of fees. Isn't this insane? just on fees alone, which equally accounts from Multi approvals.

All these and many more Dilemma users face is coming to an end with "Intent-Centric" as this transition will be from a transaction-based interaction to Intent-based approach.

Normally, a user initiates a txn, the txn is meant to follow a computational set of algorithm before finality is reached. This can be a user who has USDT on BSC and wants to stake $ETH with LIDO. The procedure would be as follow:

The user will first bridge $USDT to Ethereum

Finally now makes the deposit on LIDO. Or a more complex situation like this

The whole process, the user has to make multi clicks, approve txn and swap and deposit. Some users might not find their way around this easily but with Intent-centric approach,

it's removing such barrier for this user by getting this done without having the user experience these hurdles in the procedure.

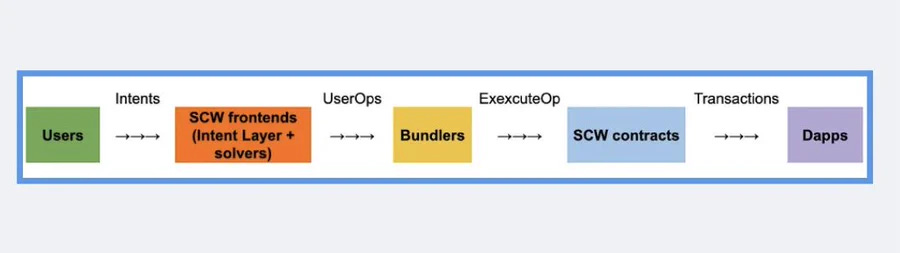

The above image shows clarity when users submit a transaction and when users submit an Intent. With Intents users specify their goal. I will simply summarize it as "Get this done and I don't care how you do it, but just get it done".

Here are some of the key players building the Intent-Centric approach:

Anoma is building an Intent-centric blockchain while flashbot is building an Intent centric infrastructure "SUAVE" (single unified auction for value expression).

Flashbot raised $60M in funding in an investment round led by Paradigm for building SUAVE. SUAVE is a decentralized network and MEV optimization innovation.

Some Intent like approach has been in existence already and taking new form, this comes down to:

Limit Orders

Cowswap style auctions

Delegation

Aggregators

Transaction batching

Gas sponsorships

Chainlink CCIP

Aside from Blockchain like Anoma and Infrastructure like Suave, When it comes to Dapps, dappOS is already building this future. wqhere is this future heading to? Account Abstraction is a good one for Intents, but only a tip of the iceberg.

Chain Abstraction too, similar to AA, but much more. dappOS V2 Is an Intent protocol which leverages both Below is a user flow for an Intent layer Dapp

dappOS is an operating protocol that aims to simplify the user experience of interacting with dApps. The upcoming dappOS V2 will introduce dappOS Account and dappOS Network, that provides Ce-Fi experience.

That's why they raised a Pre-Seed Funding Round by Binance Labs in June.

On July 21st, they futhur made the accounment of a seed round funding, co-led by IDG Capital and SequoiaChina at a valuation of $50 Million Dollars.

dappOS caught attention from great VCs and Binance becasue dappOS is believed to lead the new wave of "Intent-Centric"

Let's explore dappOS V2 tech and see how it builds towards that: dappOS v2 tech is eliminating the barrier of fragmentation that has been introduced by mutiple chains through Chain Abstraction.

Let's explore dappOS V2 tech and see how it builds towards that:

dappOS v2 tech is eliminating the barrier of fragmentation that multiple chains have introduced through Chain Abstraction.

Every account is unified, as users need to pay attention to the total amount of assets instead of individual assets across these chains. dappOS v2 is giving users that CeFI-like experience, as once funds are deposited, there is no need to differentiate based on chains.

A typical scenario of dappOS Intent-centric approach is a user who doesn't have assets on Arbitrum/Avalanche but wants to Interact with GMX. Thanks to dappOS V2's Unified Account, users can reach the intention of interacting with GMX by going to call assets on other chains.

The intent of interacting with GMX is simple, but the corresponding txn involves a series of complex and time-consuming operations when it comes to multiple-chain operations. With dappOS, users can seamlessly complete their “intent” with just one signature.

dappOS V2 introduces 1-click Multi txn, or what they call "One Signature Completes it All!" This equally solves the user's intent by eliminating the hurdles the user has to go through step by step before their txn requests can be completed.

These are just some of the few things we're about to see with dappOS V2 tech. The "Intent-Centric" narrative needs Account Abstraction, Chain Abstraction, and many more covered in this thread are sub-layers of Intents.

The future of DeFI will be based on the "Intent-Centric" approach, and I’m strongly Bullish on these Narratives and Protocols leveraging this.

In the next series, I’ll be exploring the Intent-Centric deep dive series with Anoma and SUAVE.

The DeFI Saint Recap

Impermanence Loss has been a Nightmare for LPs, but with Nabla Finance, this is coming to an end as it aims to provide deep liquidity for Crypto and RWA while maximizing yields for LPs with its Single Sided Liquidity Providing (SSLP).

ICYMI, Here’s everything you need to know about Nabla Finance

Strategic Insights to keep an eye

Earning yields on $ETH with Stader Ethereum

Here are my strategies for getting yields on $ETHx:

Strategy 1 (Wombat Strategy) APR: 25% TVL: $884k

• Stake $ETH on Stader Ethereum receive receipt token $ETHx

• Deposit $ETHx on @WombatExchange

SSLP.

Strategy 2 (Balancer Strategy) APR: 1.69 - 2.22% TVL: $7.65M

• Stake $ETH on Stader Ethereum and receive receipt token $ETHx

• Deposit ETHx-bbaWETH on @Balancer

• Earn yields on $BAL swaps fees and rewards.

Strategy 3 (Pendle FI Strategy) APY: 23.1% TVL: $3.29M

• Stake $ETH on Stader Ethereum and receive receipt token $ETHx

• Depositing ETHx-bbaWETH on Balancer gives you a BPT receipt token

• Deposit the BPT token on @Pendle_fi and earn yield on $PENDLE swaps fees, rewards, and PT-ETHx-bbaWETH.

Strategy 4 Aura Finance Strategy vAPR: 6.57% TVL: $3.88M

• Stake $ETH on Stader Ethereum and receive receipt token $ETHx

• Depositing the ETHx-bbaWETH on @pendle_fi gives you PT-ETHx-bbaWETH receipt token

• Deposit the PT-ETHx-bbaWETH on @AuraFinance and get LP PT-ETHx-bbaWETH and earn $AURA and $BAL boosted rewards.

Strategy 5 Pendle FI yield Booster Strategy (Equilibria and Penpie) APR: 17.5% TVL: 1.33M (For Equilibria).

• Stake $ETH on Stader Ethereum and receive receipt token $ETHx

• Depositing the PT-ETHx-bbaWETH on @AuraFinance gives you LP PT-ETHx-bbaWETH.

• Deposit LP PT-ETHx-bbaWETH on @EquilibriaFI and earn $EQB, $xEQB, and $PENDLE boosted rewards or

• Deposit LP PT-ETHx-bbaWETH on @penpiexyz_Io and earn $PNP and $PENDLE boosted rewards.

Recent raises to keep an eye

Thanks for reading, and if you like it, do leave feedback and forward it to your Friends. There is love in Sharing, and see you next time.

DeFI Saint

Founder, The Saints Creed.