$LBR: one of my biggest bet in the bull market

Good Morning Saints,

I hope you’re having a wonderful weekend.

If you’re reading this, you’re always one of the chosen Saints and special.

Disclosure: This is not a collaboration article as I’m an $LBR holder and strongly believe in LSD and LSDFI Narrative.

Here for the tech, but in the bulls for the money. If you believe in the bull market and in the LSD/LSDFI Narrative, then this is for you.

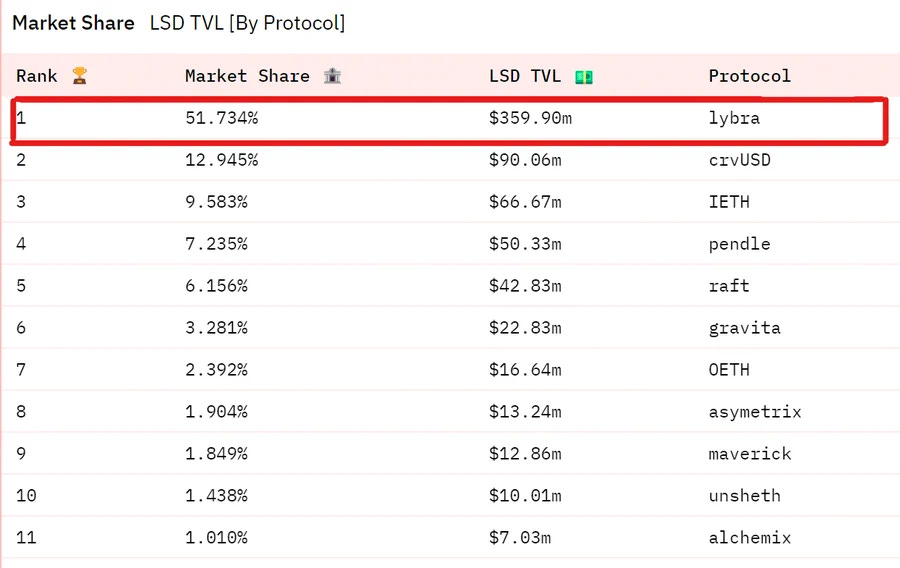

Lybra V2 was a huge upgrade to Lybra V1 and since then it has remained one of my biggest bets in the bull market,

why?

It fits every narrative; LSDFI, Omnichain with LayerZero, CDP and finally going deflationary).

Here’s my thesis on this:

To get the best out of $ETH = LSDs

To get the best out of LSDs = LSDFI

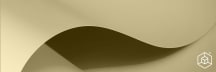

According to DeFILlama, over 11M $ETH has been staked, currently worth $19,45B, in which LIDO accounts for the largest TVL ($14.42B), with a market share of 74.58%.

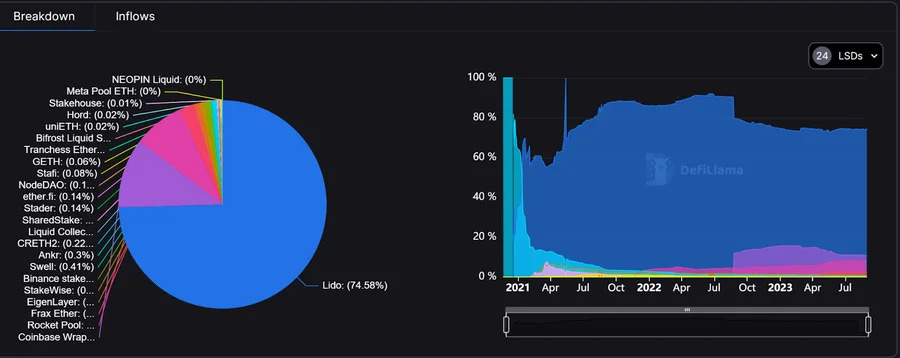

Out of $19.45B worth of $ETH locked, about $695M is locked on LSDFI protocols.

Lybra Finance has the largest market share (51.734%) with a TVL of $359.9M

The remaining $18.755B LSDs are still looking for yields; where will they go? “LSDFI” Lybra Finance stands in the position to keep dominating the shares of these LSDs

Lybra Finance will win in the long run; you know why? “Lindy Effect,” and with its V2 launch, it just got better.

Not familiar with Lybra Finance? Here’s a thread to get you started

Lybra V2 was a major upgrade to its V1 and below is a comparison of both versions.

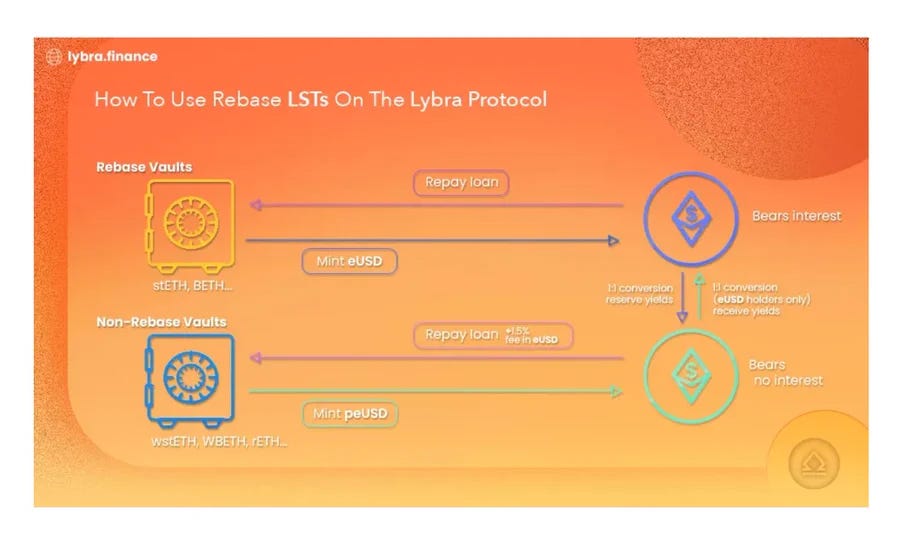

Looking at the Multiple LST collaterals, Lybra V2 is expanding far beyond $stETH. To mint eUSD, which is Lybra Overcollateralized interest-bearing Stablecoin, users can now use other LST assets like $rETH, $wstETH, $WBETH, and more.

It doesn't just end here, as Lybra V2 will feature a vault and separate pool for these LSTs. Why?

Since it does not support only $stETH, which is a rebase LSTs, other LSTs like $rETH are non-rebase LSTs; Lybra V2 will create a vault and separate pools for these LSTs.

Rebase LSTs are the type of LSTs that accrue rewards by issuing additional LSTs e.g. LIDO's $stETH; holders receive more $stETH as yields.

For Rebase LSTs, to Mint eUSD or peUSD, it follows this hierarchy:

Users deposit $stETH or any rebase LST.

Users mint eUSD with a collateral ratio of above 150%.

Users can now earn a rebase yield of around 8% APY while holding their eUSD or convert eUSD to peUSD on Ethereum Mainnet while still receiving accrued rebase yield.

Users can wish to repay their eUSD debt and also can withdraw their Collateral as long as it still falls within the designated Collateralization Ratio.

In case you're wondering, "peUSD'' is the Omnichain bridged version of eUSD, which will allow eUSD to go beyond Mainnet to be used on other L2 Chains and DeFI Protocols while still accruing interest.

This is possible due to Lybra Finance's Integration with LayerZero.

peUSD, which is an omnichain token, is compatible with a wide range of DeFi protocols. It can be utilized for various purposes, including swapping, trading pairs, perpetual contracts, lending or borrowing, and more.

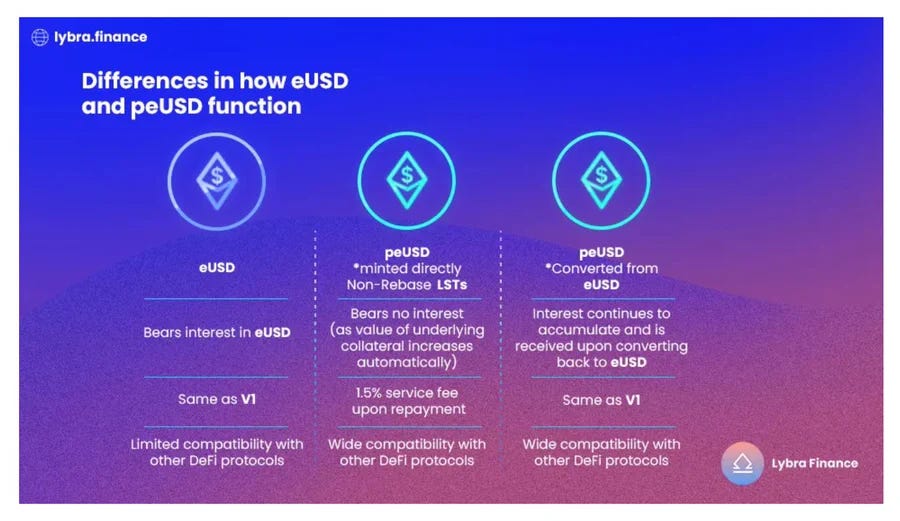

eUSD is converted to peUSD at a 1:1 ratio and keeps accruing yield, and upon converting back to eUSD, the yield is realized.

Before we delve into minting eUSD with non-rebase collateral, Users might choose to mint eUSD with rebase collateral for the following reasons:

eUSD keeps accumulating interest even when converted to peUSD

Interest is paid as eUSD, as Lybra will buy the accumulated yield on the user's rebase LST with eUSD, and eUSD is now paid as Interest to the rebase LST holders.

Let's look at using non-rebase LSTs as Collateral in Lybra V2. Non-rebase LSTs don't issue additional LSTs as yield to stakers; rather, the value of their staked asset increases as it accrues reward while the amount staked remains the same. E.g., Rocket's $rETH.

It's also keen to know that holders of non-rebase LSTs will mint peUSD directly, and peUSD doesn't bear interest like eUSD.

Why?

Since non-rebase LSTs are Value Accruing LSTs, the underlying value of the assets used as Collateral will be increasing, so there isn't a need to bear interest like eUSD, and peUSD can't be converted to eUSD as well.

In summary, holders of both types of LSTs still receive the same benefits but with different mechanisms. To mint peUSD using non-rebase LSTs, it follows this hierarchy:

Users deposit their non-rebase LST and mint peUSD directly with a collateral ratio above 150%

Minting peUSD allows users to use it for various DeFI purposes (borrowing and lending, Perpetual trading, and more).

For users to repay their peUSD debt, they pay 1.5% borrowing fees for that.

Users withdrawing their collateral will settle the borrow in peUSD.

Users can choose to use non-rebase LST as collateral due to the following reasons:

Users who wish to receive yields in LSTs rather than eUSD.

Tax efficiency

Wider functionality and use of non-rebase LSTs in DeFI

In summary, here are the major differences between eUSD and peUSD with respect to rebasing and non-rebasing LSTs.

For a quick overview of other Lybra V2 features, you can glimpse through them below.

Lybra V2 launch kickstarts with many interesting activities, which you can find in the calendar below.

It doesn't end here, as Lybra Finance always announced rewards for all users currently using their platform and users who migrate their v1 holding within the first week of the start of the v2 mining program, with the Migration reward deadline extended as well.

LBR holders, eUSD holders, and LPs on v1 will need to migrate to v2. CR (Collateral Rate) Guardians, Redemption Providers, and Liquidation Providers on v1 will need to sign up again on v2.

Like the Curve Wars, with the Lybra V2 launch, we're about to witness the Lybra Wars.

Large funds require thorough security; Lybra v2 has proven to be well-secured by undergoing multiple audits with top-tier leading audit protocols.

Code4arena

Consensys

Halborn Security

Remember the last time

BinanceResearch released a research report on LSDFI, $PENDLE was listed, and $LBR was featured. Binance research again has conducted Intensive research on emerging Stablecoin, and Lybra Finance’s $eUSD was featured.

Could we be expecting another listing on Binance soon?

Also, let's not forget that about 95% of $ETH locked on LSDs are still looking for yields, and LSDFI is positioned to capture the largest share with Lybra Finance to keep dominating with the largest market share.

It’s definitely the one to keep an eye on. Credits to Defi Mochi for its dashboard on LSDFI, as it provided easier metrics for analyzing the stats in this article.

The DeFI Saint Recap

Here are the narratives to keep your eyes on till the bull market.

Missed Gelato in the RaaS Narrative and also missed the Omnichain Narrative (LayerZero as the key player and Entangle as the Emerging player).

Another Interesting Narrative to keep an eye on is the GambleFI Narrative and Thales is definitely a key player to keep an eye on.

Looking to explore what Thales is building, here’s a thread to get you started.

Thanks for reading, and if you like it, do leave feedback and forward it to your Friends. There is love in Sharing, and see you next time.

DeFI Saint

Founder, The Saints Creed.

amazingly read . thanks for this 👌🙏