LPDFI: The next big narrative after LSDFI

To make the biggest Gains in crypto, you have to front-run the narratives.

$GMX led the Derivatives narrative

$LDO led the LSD narrative

$LBR led the LSDFI narrative

The next big narrative following LSDFI will be the LPDFI narrative, and Logarithm finance is pioneering this. How early are we?

Very early as Logarithm Finance doesn't have a token yet, but its token is already confirmed $LOG.

Here's everything we need to know about the LPDFI narrative and Logarithm:

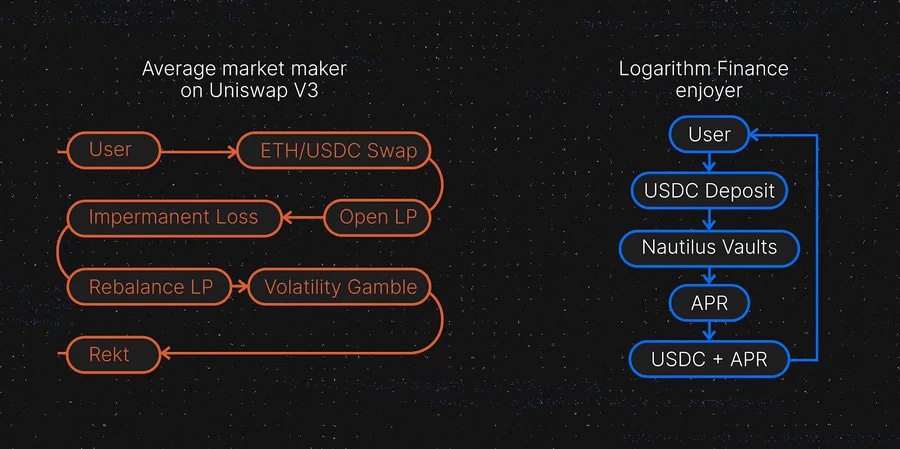

LPDFI (Liquidity Providing Derivatives Finance) Just like how LSDFI is getting the best out of LSDs, LPDFI is getting the best out of LPDs.

LPDs leverage users' LP positions to build products on top of it (options, yields, Perps, and more). It's opening whole new opportunities for users' LP positions in Uniswap V3 (or similar type AMMs) instead of users' LP positions sitting idle.

In summary, what Gamma Strategies is to LPs is what Logarithm FInance is to the user's LP position. Looking more into the Logarithm approach to LPDFI, Logarithm Finance aims to be the liquidity hub for LPDs.

It aims to do this by leveraging Delta Neutral Strategies while minimizing volatility and maximizing yield for these LPs.

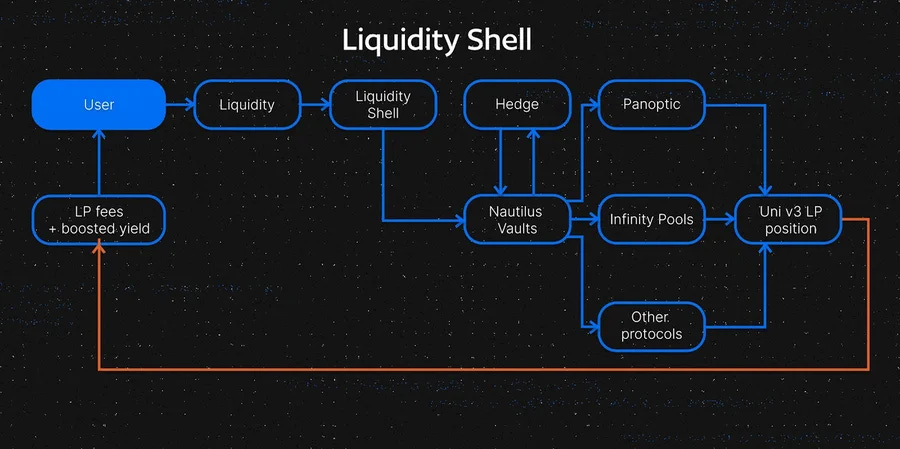

Logarithm Finance routes LP tokens via other LPDFI protocols to farm boosted yields and bootstrapping liquidity to these protocols. The Logarithm Finance Liquidity Shell is making this a reality.

Just like yield aggregator, Logarithm Finance sources across different LPDFI protocols to maximize yields for its users at that instant time and, in turn, creates seamless access to liquidity to these LPDFI protocols and Uniswap V3.

These LPDFI protocols include:

panoptic

smilee

Infinity Pool

Limitless

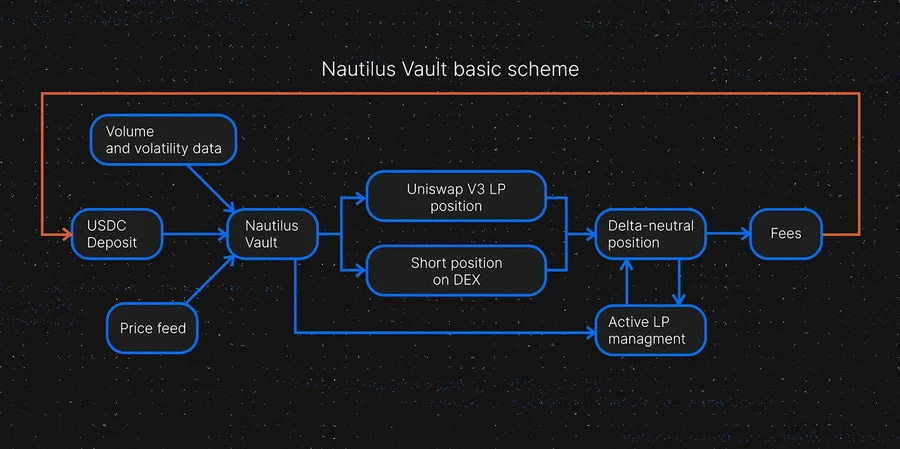

Let's take a good look at Nautilus Vault, which is Logarithm Finance’s core product and one of the features of its liquidity shell which supercharges its vision of offering Market Making as a Service.

The Nautilus vault manages uni v3 CL positions and opens a short on a perp dex (GMX) to hedge the volatile asset and ensure no IL while earning the fees.

Looking at an LP-centric approach, Logarithm Finance also fits in LAAS (Liquidity as a Service), Just like CLMs like Gamma Strategies, Dyson, DeFI Edge, and more.

In the future, the Nautilus Vault expand to other Concentrated Liquidity AMM DEXes like Chronos and more, also down to other chains as well. Talking about how Logarithm Finance will bring these real yields to users, it's keen to know where these yields come from:

LP fees from Uniswap V3

LP fees from LPDFI protocols

Logarithm Incentives for LPs in $LOG

Token emissions from LPDFI projects

Logarithm Finance, with its backtest, has proven the authenticity of these yields with an 11.8% APY.

Can't wait for the launch; it's keen to know that Logarithm Finance Beta has already been announced and will be coming soon.

Logarithm Finance token $LOG is also confirmed; there are not many details on the tokenomics distribution yet, but Logarithm Finance will be conducting a private sale for its token. You can join the discord to get early access to the beta to stay ahead of the curve.

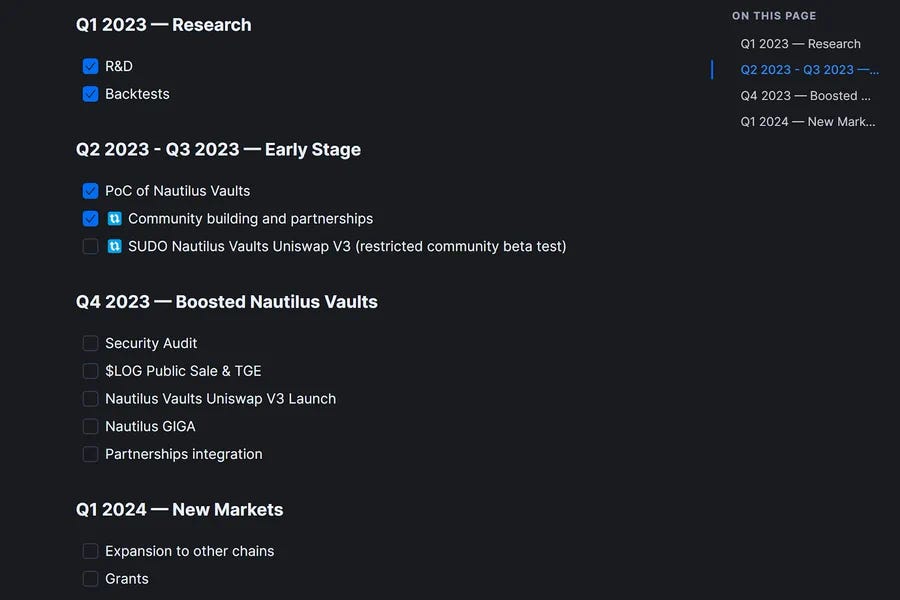

LPDFI narrative is promising, and the future of Logarithm Finance is already set. A lot of exciting things are coming on the roadmap.

You missed the LSDFI narrative, I bet you wouldn't want to miss this. I always analyze projects and place my bet on projects with multiple narratives.

Logarithm Finance is definitely one to keep an eye on; why?

Fits in Multiple Narratives

LPDFI

MMaaS (Market Making as a Service)

LaaS (Liquidity as a Service)

If you haven’t hopped into Arkham, you can do so using my referral link

will there be a second airdrop??

Thanks for reading, and if you like it, do leave feedback and forward it to your Friends. There is love in Sharing, and see you next time.

DeFI Saint

Founder, The Saints Creed.