OPTIMISM ECOSYSTEM AIRDROP COVERED

A WRAP-UP ON OPTIMISM ECOSYSTEM AIRDROP

Optimism Token got launched & the allocations issued for the airdrop was 19%, only 5% was distributed. What will happen to the rest? They will be distributed retroactively to Users who keeps interacting with the Ecosystem & other protocols. Two birds 1 Stone strategy. Nice, right?

1. Across protocol

A cross chain bridge/swap, Covered that on Arbitrum Ecosystem.

2. Bungee

A bridge aggregator, Covered that on Arbitrum Ecosystem

3. Clipper

A DEX across different chains for Swap, • Strategy: Swap & add liquidity • Airdrop confirmation: Possible Airdrop.

4. Connext

A cross chain bridge, Covered on Arbitrum Ecosystem

5. DeFI Edge

A decentralized permissionless asset management protocol built on Uniswap V3.

The protocol allows LPs to add liquidity to several strategies & earn fees based on the liquidity they provide.

Strategy: Add liquidity on an existing strategy or you can create yours since it's permissionless.

Airdrop confirmation: Possible Airdrop

6. Dex Guru

A Dex trading platform with On-chain Analytics & charting features

• Strategy: Trade across different protocols

• Airdrop confirmation: Possible Airdrop in the nearby future though plans hasn’t been laid out for that.

7. Hashflow

A bridgeless Cross-chain swap, Covered that on Arbitrum Ecosystem

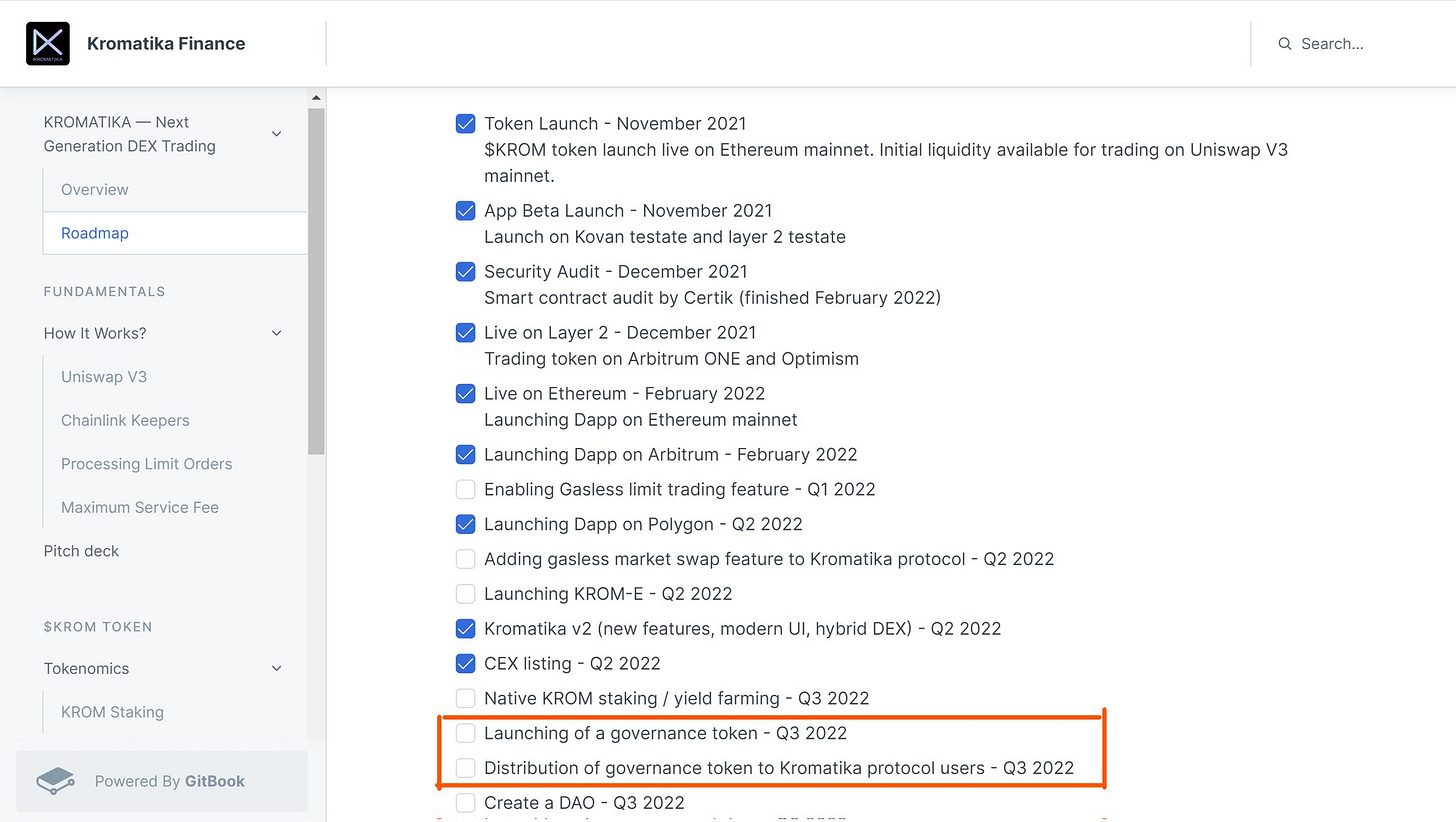

8. Kromatika Finance

A trading Dex aggregator powered by chainlink & Uniswap with yield farming limit orders & no price slippage

• Strategy: Use the protocol on limit & swap feature - Limit: Setting the target price for the order to be executed.

For using the limit function, you'll need $KROM to cover for the fees

• Swap: For using the swap function, you'll need ETH to cover for the gas fees which the fees are super cheap compared to that of Uniswap.

In other Words, Alternative to Uniswap to save fees.

• Airdrop confirmation: Confirmed Distribution of governance token to Kromatika protocol users, just like Uniswap did.

9. Kwenta

A Perp Derivative Dex trading platform

• Strategy:- SNX stakers (who have met certain requirements will be allocated 30% of the initial token supply)

• Synth Traders:- (Addresses that have used Kwenta & met the requirements will be allocated 5%)

• Airdrop confirmation:- Confirmed.

10. LIFI

A bridge aggregator & cross chain swap Covered on Arbitrum Ecosystem.

11. Matrix Farm

A multichain yield farm aggregator

• Strategy: Deposit on Matrix

NB: Clearly mentioned criteria based on Volume & How long you've deposited.

• Airdrop confirmation: Confirmed

12. Orbiter finance

A Cross-rollup bridge across all L2s

• Strategy:- bridge across various chains.

• Airdrop confirmation: Possible Airdrop, although no clear plan of token yet, but among the cheapest bridge across L2s.

13. Pika protocol

A perp derivative Dex

• Strategy:- Trade across the protocol - Add liquidity by depositing USDC in the vault Depositing USDC in the vault, 70% of trading fees are distributed to LPs

• Airdrop confirmation:- Possible Airdrop

14. Rabby

A DeFI Dex wallet

• Strategy: Use the wallet

• Airdrop confirmation: Possible Airdrop.

15. Symphony Finance

An Order Book DEX similar to that of CEX but with yield optimized trades - Yield optimized trade in the sense that when a user creates a limit order, waiting for the order to execute, the asset is deposited into a yield generating protocol like Yearn. The features allow trades to earn yield till the trades are executed on the order book:

• Strategy:- Trade across the Dex

• Airdrop confirmation:- Confirmed Retrospective rewards for order creators / executors.

16. The Granary

Granary, just like Aave, it is a DEX borrowing & lending liquidity protocol.

• Strategy: Use the protocol, deposit, borrow & lend assets.

• Airdrop confirmation: Confirmed Snapshot ongoing on weekly basis.

17. Via protocol

A Cross chain aggregator just like Bungee, LiFI & Rango

• Strategy:- Bridge & Swap across various chains.

• Airdrop confirmation:- Possible Airdrop.

18. Juno (onjuno) @JunoFinanceHQ

A web 3 crypto App/wallet

• Strategy:- Be a user

• Airdrop confirmation:- Possible Airdrop - No token launched yet